Planned Giving

Charitable Lead Trust

Your hard work has paid off and your business is growing. How can you preserve some of its value for your family?

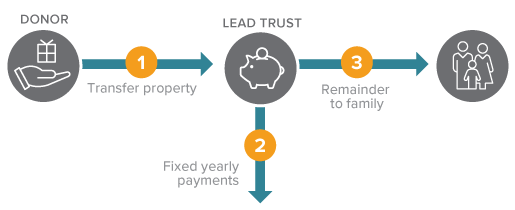

How It Works

- You contribute securities or other appreciated assets to a Charitable Lead Trust. Our suggested minimum gift is $1,000,000.

- The trust makes annual payments to Springbrook Foundation for a period of time.

- When the trust terminates, the remaining principal is paid to you or heirs.

Benefits

- Income payments to us for a term reduce the ultimate tax cost of transferring an asset to your heirs.

- The amount and term of the payments to Springbrook can be set so as to reduce or even eliminate transfer taxes due when the principal reverts to your heirs.

- All appreciation that takes place in the trust may go tax-free to the individuals named in your trust.

Next

- More details about Charitable Lead Trusts.

- Frequently asked questions about Charitable Lead Trusts.

- Contact us so we can assist you through every step.