Planned Giving

Gifts of Life Insurance

Make a significant gift to Springbrook Foundation even without a large estate. Here's how you can leverage your dollars for a larger gift.

How It Works

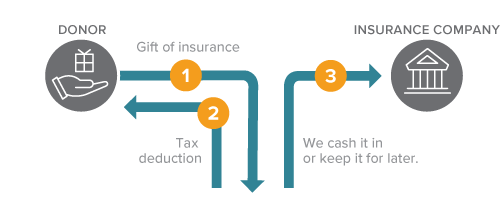

- You transfer ownership of a paid-up life insurance policy to Springbrook Foundation.

- Springbrook elects to cash in the policy now or hold it.

- Consider naming Springbrook in your long-term plans. It's simple.

Benefits

- Make a gift using an asset that you and your family no longer need.

- Receive an income tax deduction equal to the cash surrender value of the policy.

- You may be able to use the cash value of your policy to fund a gift that delivers income, such as a deferred gift annuity.

Next

- More details on gifts of life insurance.

- Frequently asked questions on gifts of life insurance.

- Contact us so we can assist you through every step.