Planned Giving

Gifts from Your Will or Trust

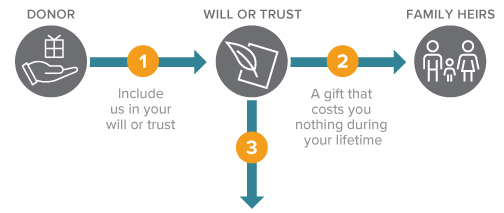

Need to preserve assets? You can plan a gift to us that will take effect only after your other obligations are fulfilled.

How It Works

- Include a gift to Springbrook Foundation in your will or trust. (Here is sample bequest language for your will.)

- Your bequest will support the overall mission of Springbrook.

- Indicate that you would like a percentage of the balance remaining in your estate or trust, or indicate a specific amount.

- Tell us about your gift so we may celebrate your generosity now.

Benefits

- Your assets remain in your control during your lifetime.

- You can modify your gift to address changing circumstances.

- You can direct your gift to a particular purpose (be sure to check with us to make sure your gift can be used as intended).

- Under current tax law, there is no upper limit on the estate tax deduction for your charitable bequests.

Please click here to let us know if you have already included Springbrook Foundation in your estate plan or if you are considering doing so. Thank you.

Please click here to let us know if you have already included Springbrook Foundation in your estate plan or if you are considering doing so. Thank you.

Next

- More detail about gifts from your will or trust.

- Frequently asked questions.

- Estate Planning Guide.

- Download: 25 Estate Documents You Need to Put in One Place.

- Contact us so we can assist you through every step.